We are positive on AEON’s efforts to reduce the strain on sales with cost-saving measures, but overall, we expect the whole of FY2020 to be weaker than last year (-26% YoY) on weaker consumer sentiment. Overall, we expect the 1HFY20 to be weaker than last year, while 2HFY20 could offer some relief if consumer sentiment and spending recover. AEON will introduce similar promotions which have been shelved before (101 days Ramadhan and Aidilfitri campaigns) to entice consumer spending. Nonetheless, AEON expect it will take some time for consumers to resume their daily spending pattern, projected to take up to at least 6 months. AEON expect a surge in demand post-MCO with immediate surge from Ramadhan and seasonally Hari Raya demand. On the property management side, rental waiver during MCO and post-MCO will be reviewed on a case-by-case basis.Įxpecting a surge in demand post-MCO. Note that there was no lay-off of permanent staffs, only re-aligning focus to support tele-marketing, personal shoppers and other related digital marketing. March (c.70% of operational area closed) helped to generate savings through: (i) electricity costs (which includes 15% discount on electricity for up to 6 months under government stimulus budget), (ii) lower maintenance works including lower numbers of contract staff (cleaning services, etc), (iii) re-negotiation with landlords on leasing agreement, (iv) better terms with suppliers on inventory arrangement, and (v) major CAPEX being shelved including renovation works, with revised focus on maintenance works at less than RM100m (previously RM400m in total). Closures of some parts of its malls starting 18th

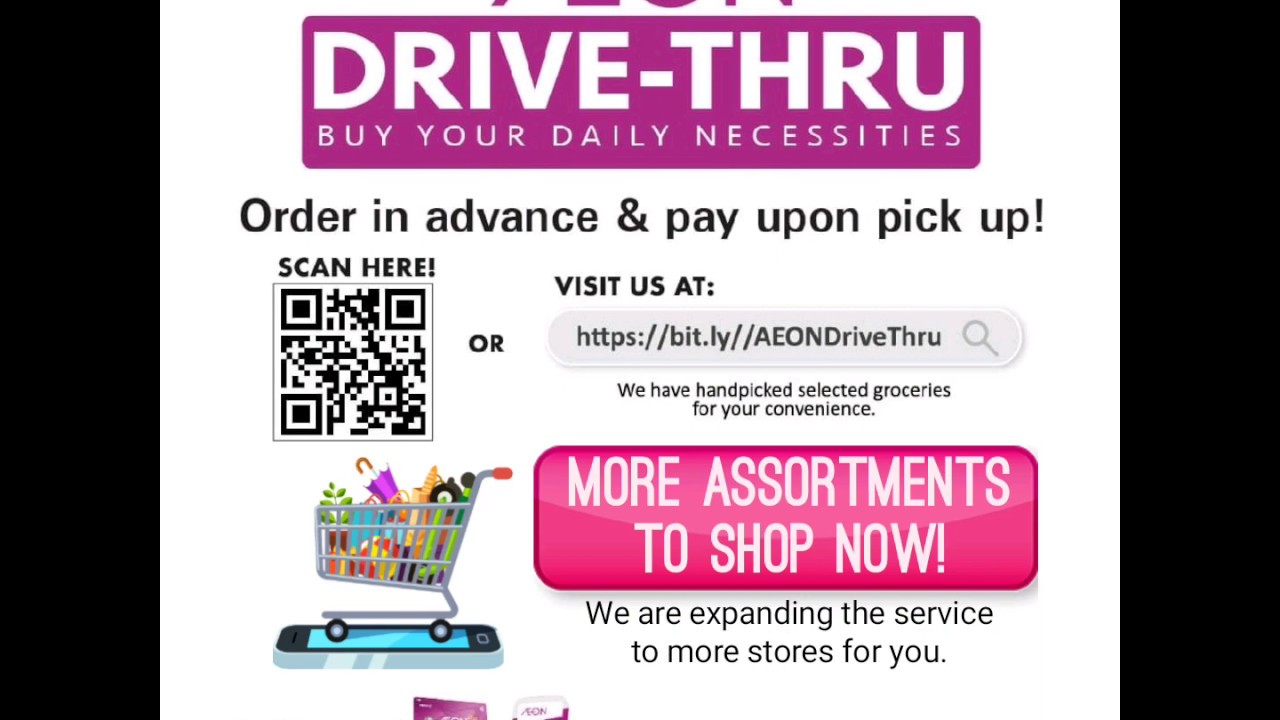

Supply chain disruption was minimal affecting some items sourced from China and Australia, but AEON has re-aligned such supply line from locals such as vegetables and fruits from Cameron Highland.Ĭost-saving measures. Note that, pre-MCO, its supermarket segment accounted for 50% of total sales, while during MCO, its supermarket saw a 20% increase in basket size. Nevertheless, with the closure of wet market and “pasar pagi”, there has been a surge in new costumers’ footfalls especially for the open-concept malls such as AEON Tebrau, and malls within 10-km radius of residential area (neighbourhood malls). AEON saw panic buying with double-digit growth in retail sales up to 17th March, but after MCO, sales dropped by c.70% sales from the same time last year which averaged to about 10% drop for the March, which also translated into negative SSSG growth of 10% compared to positive low-single digit growth last year. Only its supermarket segment is operational with enhanced measures during MCO such as tele-marketing, personal shoppers, drive-thru, in house delivery services and online sales through Happy Fresh. We maintain our MP call and TP of RM1.05. Note that, we have cut our FY20E/FY21E CNP by 27%/20% in our consumer strategy report dated 2 nd April 2020.

No changes to our estimates as we have already factored in the negative impact of Movement Control Order (MCO). We are positive on its efforts to alleviate the strain on sales with cost-saving measures, but overall, we expect FY2020 to be weaker than last year (- 26% YoY) on weaker consumer sentiment. We maintain our cautious view after a conference call with AEON’s ED, Mr.

0 kommentar(er)

0 kommentar(er)